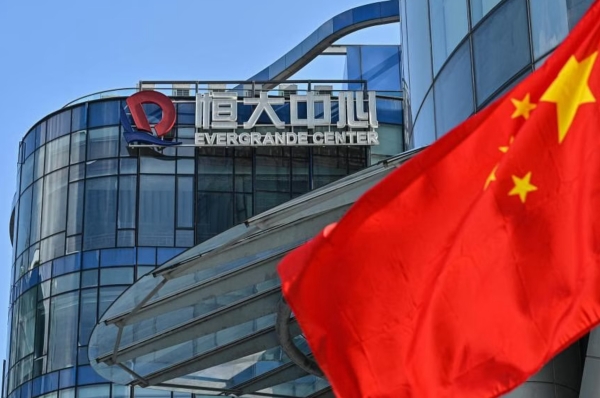

Debt-laden Chinese property giant Evergrande has been ordered to liquidate by a court in Hong Kong

With more than $300bn (£236bn) in debt, the company has become the face of China’s real estate problem.

When Evergrande stopped paying its debts two years ago, it shook the world’s financial markets.

Judge Linda Chan said "enough is enough" because the developer in trouble kept failing to come up with a way to restructure its bills.

As for Evergrande, its executive director, Shawn Siu, said the move was "regrettable" but that the business would still run in mainland China.

In a statement, he also said that the company’s Hong Kong branch was separate from its Chinese operation.

It’s not clear yet how the decision might affect Evergrande’s home building business, but many people who bought homes from the company are already waiting for their new homes because of the crisis.

People in China have been using social media sites like Weibo to vent their anger at companies like Evergrande, and Beijing has tried to calm the public’s fears about the housing market.

AdvertisementThere will probably be more changes in China’s financial markets after the court’s ruling. This comes at a time when the government is trying to stop a stock market sell-off.

About a quarter of the world’s second-largest economy comes from China’s real estate market.

After the news came out on Monday, Evergrande stock dropped more than 20% in Hong Kong. The trading of the shares has been stopped for now.

When a business goes through liquidation, its assets are taken away and sold off. After that, the money can be used to pay off bills.

Before today’s decision, the Supreme Court of China and the Department of Justice of Hong Kong signed a deal that lets civil and commercial decisions between mainland China and Hong Kong be recognized and enforced by each other. This deal goes into effect today.

But the Chinese government might decide not to follow this process, and the bankruptcy order doesn’t always mean that Evergrande will fail and shut down.

It was one of its investors, Hong Kong-based Top Shine Global, who brought the case in June 2022. They said that Evergrande had broken a deal to buy back shares.

But what they are due is a very small part of what Evergrande owes.

Most of the money that Evergrande owes is to lenders in mainland China, who don’t have many legal ways to get their money back.

Foreign bondholders, on the other hand, can take their cases to courts outside of mainland China. Some have chosen Hong Kong, where Evergrande and other developers are listed, as their court of choice.

After a winding up order, the directors of a company will no longer be in charge.

Derek Lai, global insolvency leader at professional services company Deloitte, says that the court is likely to choose a provisional liquidator. This person could be a government worker or a partner from a professional firm.

A formal liquidator will be chosen within a few months, after talks with creditors.

While "one country, two systems" is a slogan, most of Evergrande’s assets are in mainland China, where there are tough problems of who has power.

The courts of China and Hong Kong have agreed to recognize the appointment of liquidators. However, Mr. Lai says that as far as he knows, "only two out of six applications" have been accepted by courts in three test areas in mainland China.

The Chinese Communist Party also wants to keep developers in business so that people who bought homes before construction started can get what they paid for.

In other words, Beijing could choose to ignore the court order from Hong Kong.

Also, it’s not likely that foreign borrowers will get their money before mainland creditors.

There is a strong message sent by Judge Chan’s decisions, even if they are not followed in China. This shows other developers and creditors what they may have to deal with.

Share this article: